Keystart continues to update property price limits and income limits to support more Western Australians into home ownership.

Keystart is pleased to announce that we are again adjusting our product settings to ensure they remain appropriate to the conditions of the market, following an earlier July increase to property price limits and income limits for both Low Deposit and Shared Ownership Home Loans.

The changes will be effective from 19 December 2024.

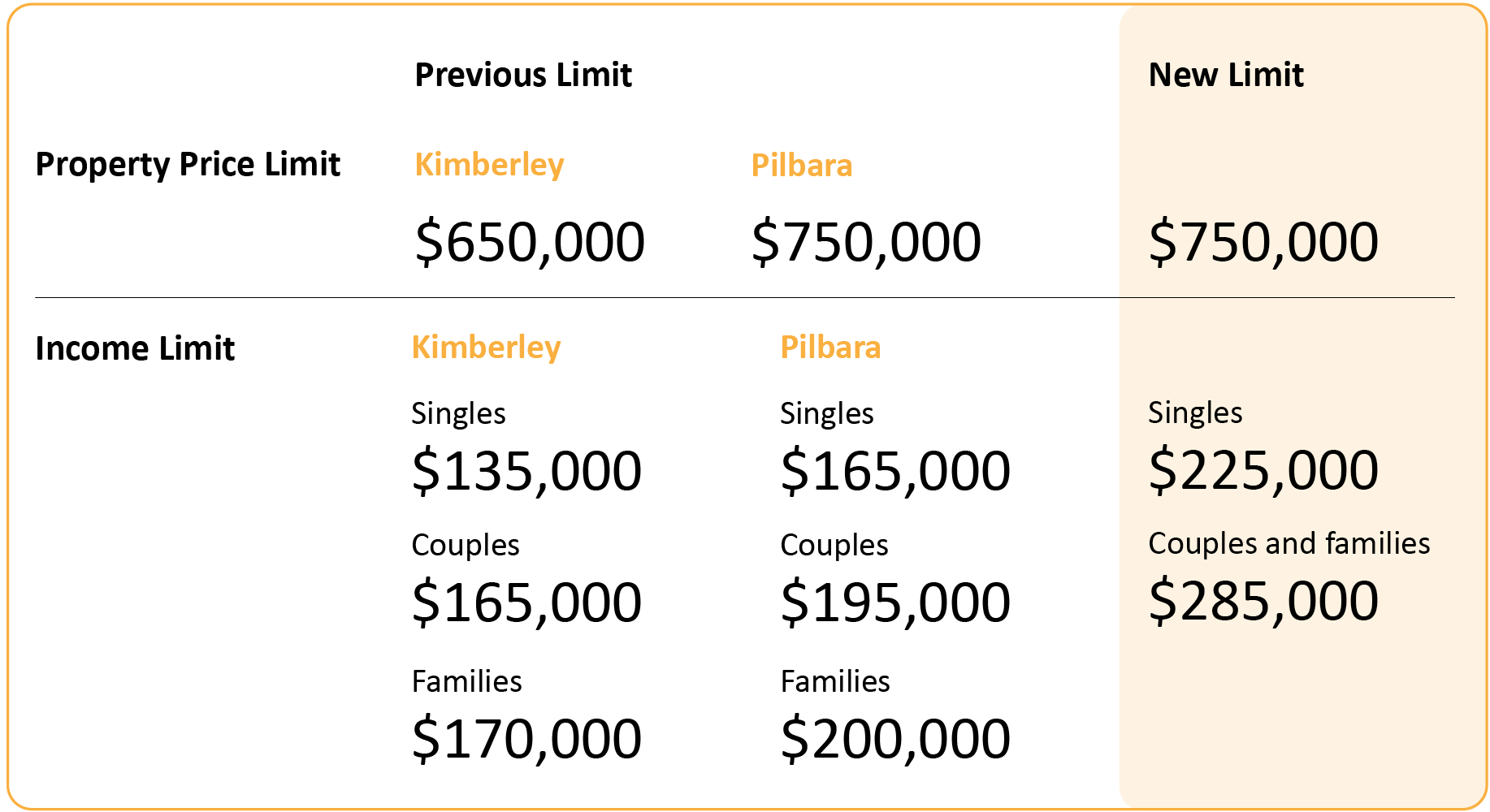

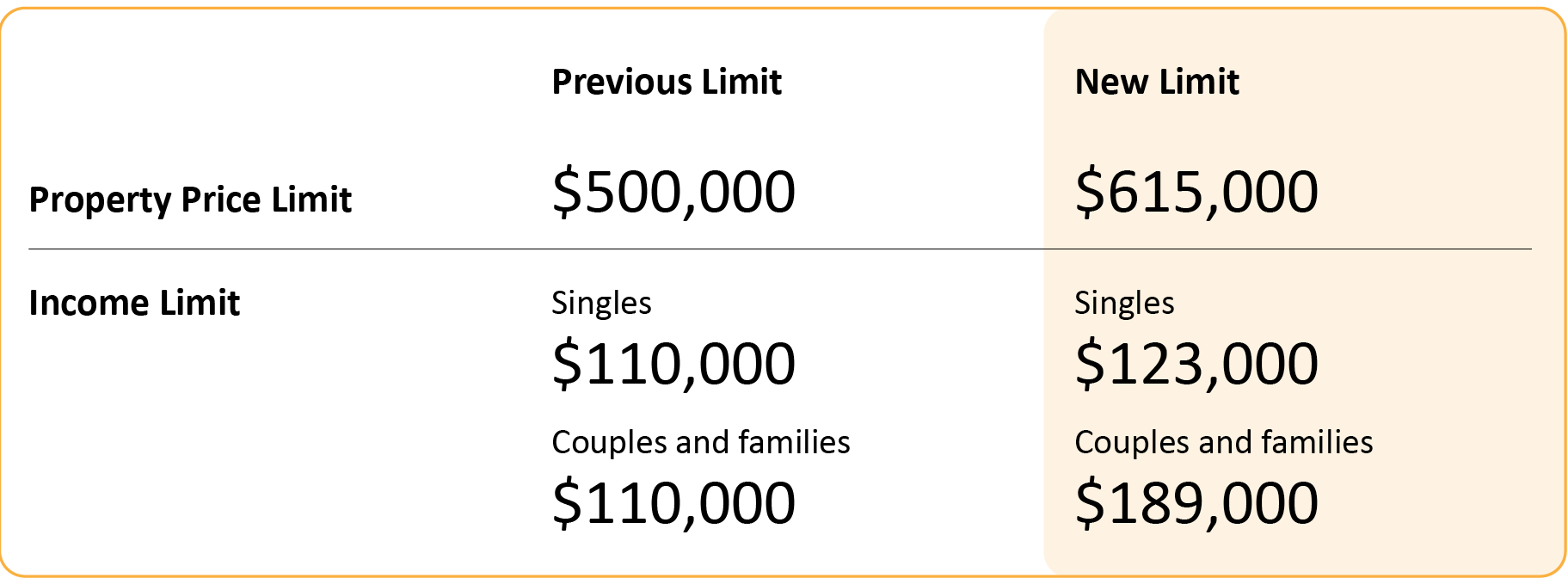

The changes being announced today cover all regions, with specific adjustments being made in the Kimberley and Pilbara to reflect the unique property market conditions and higher living costs in the region.

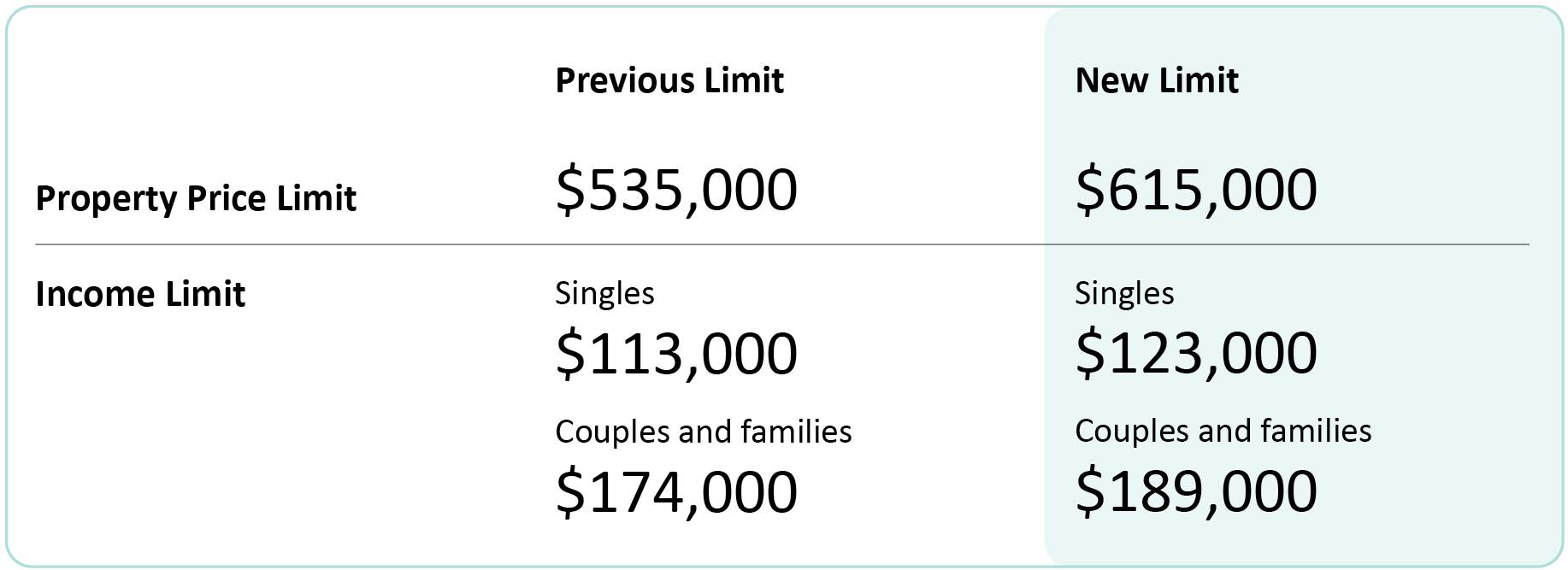

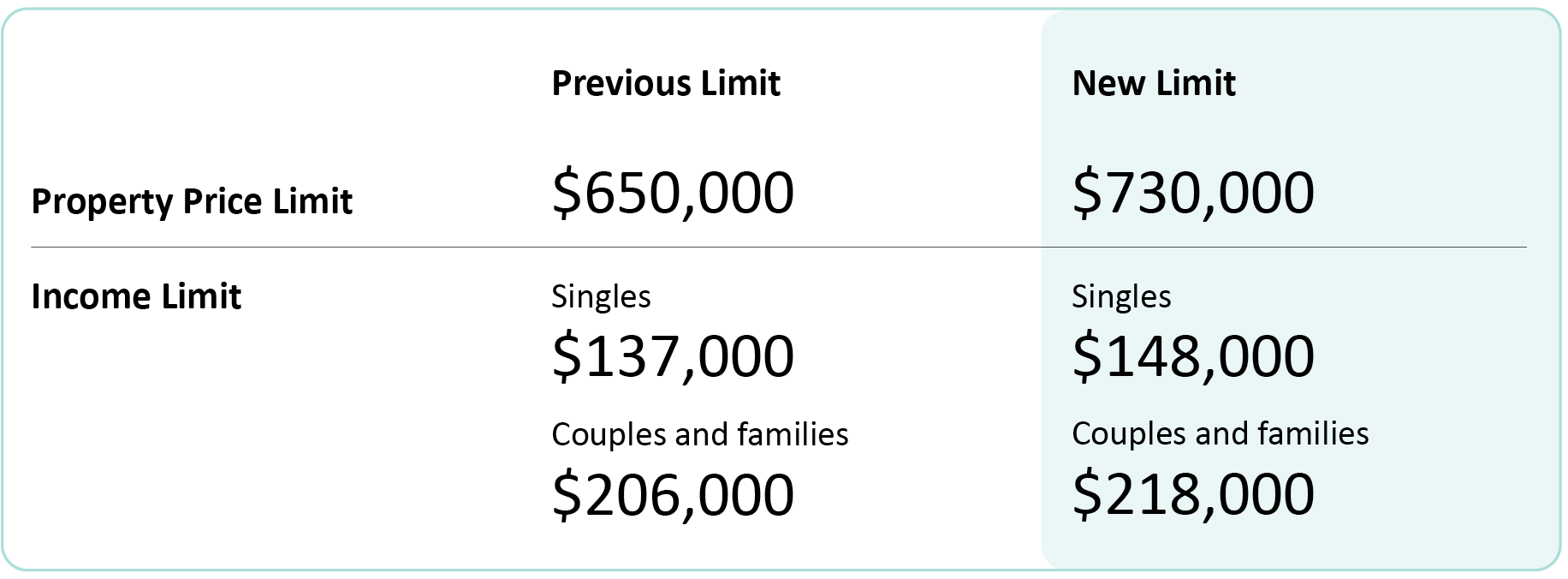

The following changes are applicable for all of Western Australia (with the exception of the Kimberley and Pilbara which are highlighted in tables below):

Metro and Regional: Low Deposit Home Loan

Metro and Regional: Shared Ownership Home Loan

Kimberley and Pilbara: Low Deposit Home Loan

Kimberley and Pilbara: Shared Ownership Home Loan

By adjusting property price and income limits, Keystart is providing a practical pathway to homeownership for more individuals and families.

“The changes introduced in July are already providing more opportunities for Western Australians to become homeowners. We've seen a notable increase in enquiries following July's announcement and expect this trend to continue after today's announcement,” said Keystart's Chief Executive Officer, Mark Tomasz.

“By regularly reviewing the settings, we are ensuring that Keystart's products adapt to the changing dynamics of the property market, further supporting our vision of making affordable home ownership a reality for more people.

“Keystart is committed to adapting and evolving our product offerings to meet these challenges, ensuring that more Western Australians have the opportunity to secure a home of their own.”

Our new property price limits and income limits will see more Western Australian's eligible for the scheme. Property price limits will continue to be reviewed periodically against annualised median house price data sourced from REIWA. Income limits will reflect the income required to service the property price limits.

These settings are dynamic and will increase or decrease to reflect market conditions.

For media enquiries contact:

Clarity Communications

(08) 9380 0700